Malaysia’s RHB Banking Group has become the first financial services firm in Southeast Asia to officially adopt IDEMIA‘s Motion Code solution for payment cards.

First announced back in 2017 by Oberthur Technologies – prior to its merger with Safran Identity and Security to form what is now IDEMIA – the Motion Code solution revolves around the use of a dynamic CVV, rather than the traditional static one. That means the secret security code displayed on the rear of a given payment card will periodically change, with a new number generated by a complex algorithm, to help ensure that a stolen or lost card can’t be used to conduct secure transactions online.

“With this solution that we have built together with RHB, we can help increase online transactions, and prevent fraudulent transactions at the same time, where fraudsters attempt to use stolen card data to make purchases,” explained Visa’s Malaysia head Ng Kong Boon in a statement announcing the development, adding later, “This is crucial for the growth of electronic payments in the country, and Malaysia to become a more digital nation.”

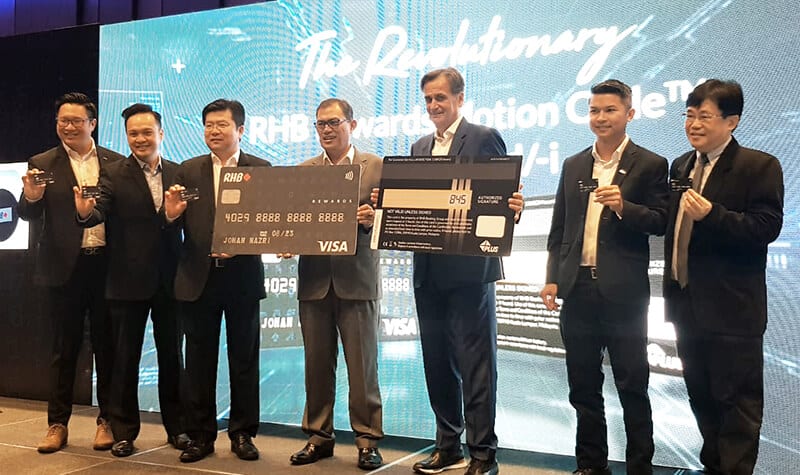

RHB has embraced this technology in its new RHB Rewards Motion Code Credit Card, in collaboration with IDEMIA and Visa. The card is aimed at offering customers rewards points for spending on cinema visits, health, insurance, overseas purchases, and, of course, online shopping, among other things. RHB will offer its customers a waiver for the first year of the card’s annual fee, and expects to issue 21,000 of these cards annually.

The card represents one form of a new and emerging generation of payment cards designed to more effectively fight fraud, with both Visa and IDEMIA also active in the burgeoning area of fingerprint-scanning biometric payment cards.

Follow Us