The biometrics industry has seen a huge amount of venture capital investment this year, with startups in the facial recognition space attracting particularly strong interest through early-stage funding rounds. Selfie onboarding specialist Jumio, for example, announced a $150 million funding round in March; and AnyVision recently raked in $235 million in a funding round led by SoftBank, one of the most prestigious funds in the world focused on hi-tech growth opportunities.

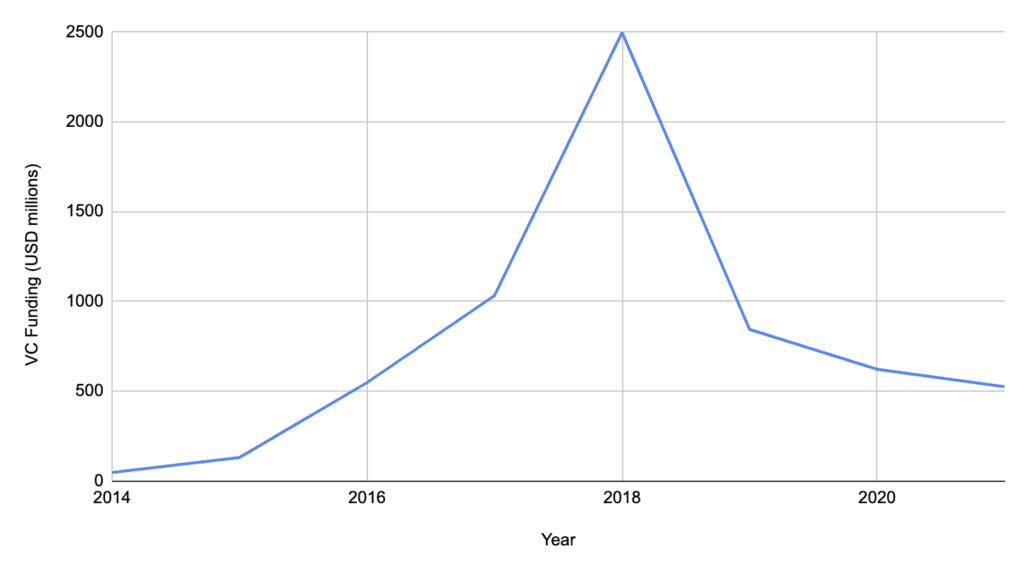

Statistics compiled by CrunchBase indicate that at the time of writing, investment capital for facial recognition companies in 2021 already amounts to $524.9 million, suggesting explosive growth in comparison to the $622.5 million in funding that flowed into facial recognition for the entire year of 2020. So is facial recognition entering into a new, hyper-growth phase?

Maybe. But it’s important to zoom out and get a sense of the bigger picture here. Investment capital may be pouring into facial recognition in 2021, but it actually pales in comparison to an earlier wave of investor excitement.

Gradually, Then Suddenly

The real boom in private capital for facial recognition kicked off in 2016. The year before saw a total of $130.8 million generating through funding rounds in this space. In 2016, that number skyrocketed to $548.3 million. And it kept going: the cumulative total of capital raised through funding rounds went to $1.03 billion in 2017 and then rose to just shy of $2.5 billion in 2018 before coming down to $843.9 million in 2019 and $622.5 in 2020. If the pace of funding hadn’t picked up so strongly in the first half of 2021, one might have concluded that private investment already peaked a couple of years ago.

So what happened? Why did interest in this space skyrocket in recent years? A number of factors were likely in play, but a couple of major developments are worth highlighting. The Department of Homeland Security’s US Customs and Border Protection agency only started trialing the use of facial recognition at airports mid-decade, and it really got the ball rolling on what would become an expansive, ambitious biometric border control program in the following year, prompting air travel partners in the private sector to begin exploring the advantages of biometric technologies themselves. This dovetailed with a growing interest in facial recognition among national security and law enforcement agencies – another trend that has risen in prominence in more recent years.

The Mobile Biometrics Boom

But the flow of venture capital isn’t so much dictated by government sector activity as it is by what’s happening in the private sector, and particularly in consumer-facing areas. And that brings us to what is perhaps the key driver of VC interest in facial recognition over the past several years: mobile biometrics. In the middle of the last decade, facial recognition technology was starting to trickle into the mainstream via mobile applications. By 2016, FacePhi, now one of the most prominent providers of selfie-based onboarding in the financial services sector, was starting to gain real traction, while global giants like Mastercard and Samsung were exploring the use of facial recognition for user authentication and payment authorization.

This activity would have already been stoking interest among Silicon Valley; and when Apple brought facial recognition to its iconic iPhone line in late 2017, that surely added fuel to the fire. The move had an outsized impact on the mobile industry, prompting mobile rivals across the price spectrum to look for facial recognition solutions that could be implemented in their own devices. It’s impossible to say how big a factor this was in motivating further investment in facial recognition, but it surely isn’t a coincidence that capital raised in funding rounds more than doubled between 2017 and 2018.

The impact of selfie biometrics may also help to explain the dip in VC capital that came in 2019 as the development and implementation of such technologies in consumer smartphones started to normalize and go mainstream. And it would make sense for investment capital to drop further in 2020, when COVID-19 brought extremely disruption to consumer tech supply chains and uncertainty to the broader economy.

Now, in 2021, it looks like investor interest is once again accelerating. Interest in the remote onboarding solutions that selfie biometrics can offer has intensified in the wake of the pandemic, with so much activity having shifted – in some cases permanently, it seems – into online channels. Meanwhile, new applications of facial recognition technology are being explored, from physical access control to surveillance.

And the good news for startups and even more established firms in this space is that the funding is coming from myriad sources. While some of the biggest investors have made bets in multiple funding rounds – four for Alibaba Group, for example, and five apiece for Qualcomm Ventures and Venture Kick – a sampling of the major funding rounds announced this year shows almost no overlap between investors that led the rounds:

| Company | Lead Investors |

| AnyVision | SoftBank, Eldridge |

| Paravision | J2 Ventures |

| Keyless | P101 SGR |

| Incode | DN Capital, 3L Capital |

| Jumio | Great Hill Partners |

| LoginID | Fabrice Grinda, Will Wang Graylin, George Wallner, Damien Balsan |

| Alcatraz AI | Ray Stata |

Factor Risk

It’s undeniable that a remarkable amount of money is flowing into facial recognition, but as the technology has increasingly gone mainstream, it has also brought to light one key risk factor that must be taken into consideration: pushback over ethical concerns. Activists associated with privacy, civil rights, and racial justice have been increasingly vocal about the threat of facial recognition technology when it’s used intrusively – such as in the identification of protestors in the United States – and oppressively, as in China’s massive surveillance and carceral program against Uyghur Muslims in Xinjiang. There are also serious concerns about disparities in the accuracy of facial recognition systems across the lines of gender and race, resulting in discriminatory outcomes.

These are the kinds of concerns that prompted Microsoft to refuse to sell its technology to law enforcement and to divest from AnyVision – even after an audit cleared the latter of being involved in mass surveillance in the West Bank. And the aforementioned nefarious activities in Xinjiang have even landed some facial recognition firms on US blacklists – including a company backed by Sequoia Capital, one of the most respected VC firms in Silicon Valley.

Some industry leaders have been pushing for greater transparency in the industry and even for more government regulation in a bid to mitigate these ethical concerns. And while there is undeniably an ethical imperative to address issues of privacy, civil rights, and racial bias, there is also a strong business case for it. Deep-pocketed investors are clearly interested in facial recognition, and addressing the risks posed by ethical issues facing the industry will only help to encourage further investment going forward.

—

(Originally posted on FindBiometrics)

Follow Us